Bank of Canada Cuts Rates by 50 Basis Points: What It Means for Your Mortgage

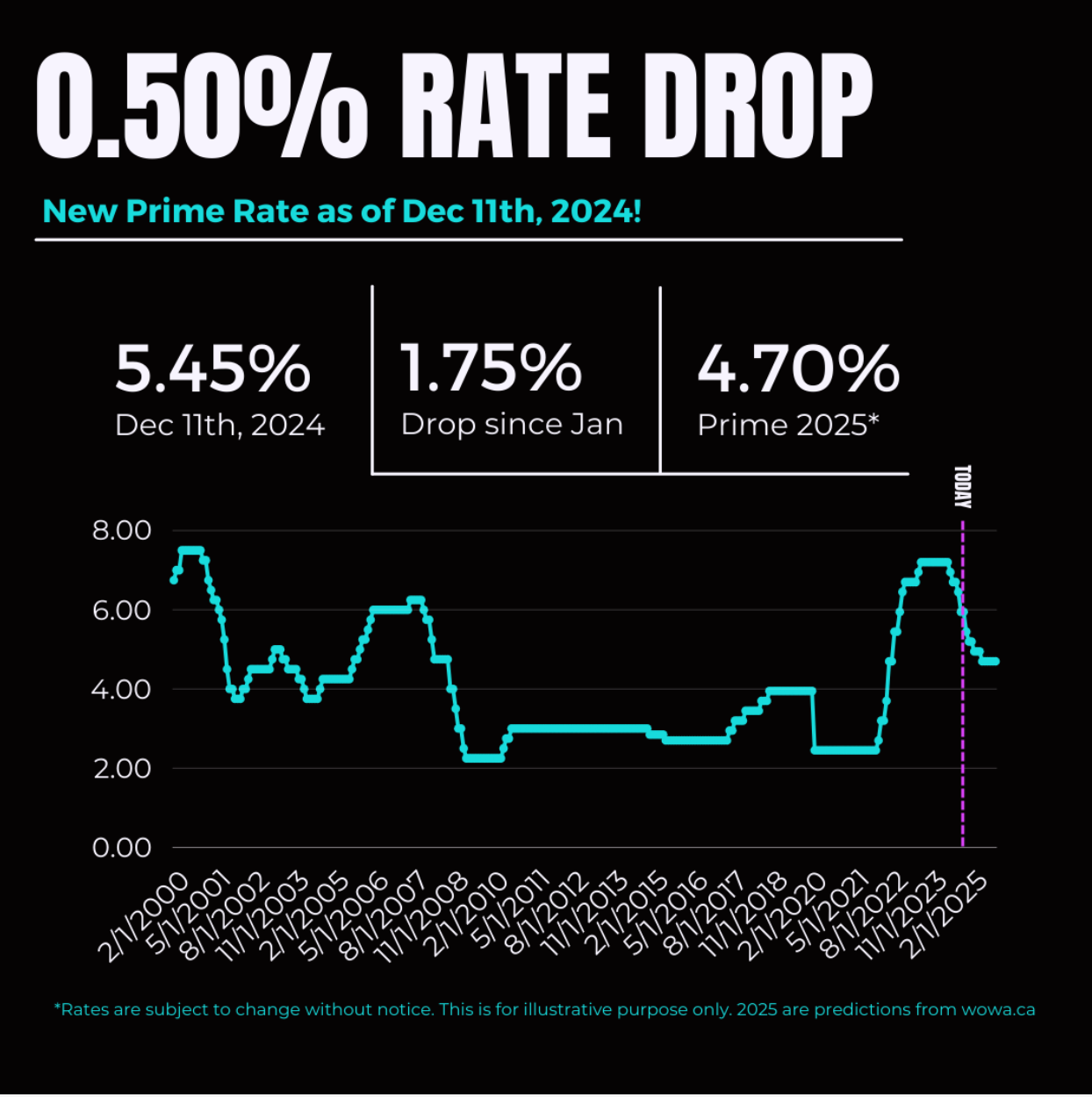

The Bank of Canada recently made headlines by cutting its benchmark interest rate by 50 basis points, a move aimed at providing relief to borrowers and stimulating economic growth. This rate cut—the second in recent months—is a game-changer for homeowners and prospective buyers alike. As your trusted mortgage broker, we’re here to break down what this means for you and how it could impact your financial decisions.

Key Highlights of the Rate Cut

- Lower Borrowing Costs: The rate cut reduces borrowing costs for variable-rate mortgage holders and those seeking new financing. Adjustable-rate mortgage holders will see immediate savings, while prospective buyers can benefit from more affordable loans.

- Refinancing Opportunities: For homeowners with fixed-rate mortgages approaching renewal, this may be the perfect time to refinance and lock in a lower rate, potentially saving thousands.

- Boosted Buyer Activity: Lower rates could fuel increased activity in the housing market, creating opportunities for both buyers and sellers.

What This Means for You

For Current Mortgage Holders: If you hold a variable-rate mortgage, you’re likely to see a reduction in your monthly payments. This is a great time to explore options like consolidating debt, funding home improvements, or upgrading to a larger property.

For First-Time Buyers: Reduced rates make homeownership more attainable by increasing affordability and borrowing capacity.

For Real Estate Investors: Lower borrowing costs enhance profitability, making this an opportune moment to expand your portfolio or diversify your investments.

How I Can Help

Navigating market shifts can be complex, but I’m here to simplify the process and provide tailored solutions to meet your needs. Here’s what I can offer:

- Mortgage Reviews: I’ll analyze your current mortgage to identify savings opportunities and help you make informed decisions.

- Pre-Approvals: Secure a pre-approval to understand your budget before entering the housing market and lock in a rate for up to 120 days.

- Customized Advice: From first-time buyers to seasoned investors, I can provide guidance to ensure you maximize your benefits under the new rate conditions.

Why Stay Informed?

Understanding market trends is key to making smart financial decisions. This rate cut is an opportunity to reassess your mortgage strategy, whether you’re planning to buy, sell, or refinance. I encourage you to reach out for a no-obligation consultation to explore how these changes could benefit you.

Don’t let market changes pass you by. Whether you’re looking for advice on your current mortgage or exploring new opportunities, we’re here to help. Contact us to schedule a consultation and take the first step toward achieving your financial goals.

📞 403-968-2784

📧

christine@flaremortgagegroup.com

🌐 Visit: www.mortgagesbychristinem.ca