Should I renew or refinance my mortgage_

Should I renew or refinance my mortgage?

Millions of Canadians are reaching the end of their mortgage term, eager to secure the best possible rate. While many focus on renewing their existing mortgage, they may overlook the possibility of refinancing—a decision that could make a big difference in their financial picture.

What’s the Difference Between Renewal and Refinance?

- Renewal:

At the end of your mortgage term (commonly 5 years), you need to “renew” your loan to keep it active. When you renew, your mortgage balance and amortization period (the total time you have to pay it off) stay the same. You can renegotiate your interest rate, but you can’t borrow additional funds or change the original loan amount.

Example. You bought a home in June 2020 and had a mortgage of $400,000. After a 5-year term at 1.70%, your outstanding mortgage balance will be around $332,939.71, assuming you haven’t made any extra payments. At this point, you’ll need to renegotiate a new interest rate and choose a new term based on your remaining balance. - Refinance:

Refinancing allows you to restructure your mortgage. You can change the loan amount, extend the amortization period, and often access your home’s equity. This flexibility gives you the option to lower monthly payments, consolidate debt, or free up cash for other purposes like renovations or investing.

Example: Say your home’s value has grown significantly since you first purchased it. Through refinancing, you could borrow more against that increased equity, giving you funds to complete a kitchen renovation, start a small business, or pay off higher-interest debts.

The Impact of Rising Rates

If you locked in a 1.70% fixed rate five years ago, today’s rates—often over 4.50%—may feel like a big leap. Simply renewing might leave you with a payment shock. Refinancing, however, gives you the ability to adjust your monthly obligations, even as rates rise, by stretching out your amortization or accessing equity for financial goals.

A Side-by-Side Comparison (Markdown Table)

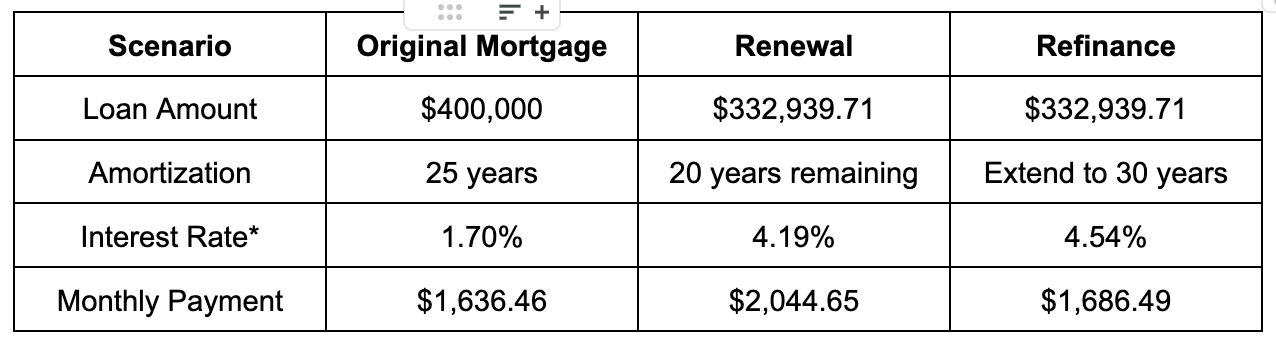

Below is a comparison of a $400,000 mortgage at a 1.70% interest rate (renewal scenario) versus refinancing to a longer amortization period with a higher rate:

*Rates are for illustrative purposes only. This is not a commitment to lend, pre-approval or approval. OAC, E&O.

Note: The monthly payment in the refinance scenario is higher due to the higher rate, but stretching out the amortization period can still offer savings compared to shorter-term loans.

Simplifying the Terminology

- Amortization Period:

This refers to the total length of time you have to fully pay off your mortgage. For example, a 25-year amortization means your mortgage is structured to be paid in full over 25 years. Choosing a shorter amortization period typically results in higher monthly payments, but you’ll pay less interest overall. A longer amortization period, such as 30 years, reduces your monthly payment but increases the total interest paid over the life of the loan. - Term:

The term is the length of your current mortgage agreement with the lender—commonly 1 to 5 years in Canada. At the end of this term, you need to renew or refinance your mortgage for another term at current interest rates and conditions. While the amortization period stays the same, the term allows for adjustments to the rate and sometimes the type of mortgage you have. - Equity:

Equity is the portion of your home that you truly own, calculated by subtracting the outstanding mortgage balance from your home’s current market value. For example, if your home is worth $600,000 and you owe $400,000 on your mortgage, you have $200,000 in equity. Refinancing can enable you to tap into this equity for expenses like home renovations, debt consolidation, or investment opportunities. - Payment Shock:

This occurs when your mortgage term ends and you’re faced with significantly higher interest rates. The resulting increase in your monthly payment can come as an unpleasant surprise and impact your budget.

In Summary

When faced with renewal, don’t just look at the rate. Consider your overall financial goals. Do you need to borrow additional funds? Are you trying to reduce monthly payments? A refinance may give you more flexibility and options than simply renewing. By understanding the differences and terminology, you can make a well-informed decision that best fits your long-term financial plan.

If you’re unsure which option is right for you, let’s connect. I can help you understand your choices, find the best rates, and create a mortgage strategy tailored to your needs. Reach out today to explore what’s possible!