Capital Gains Tax Rules: Are They Changing?

With all the uncertainty surrounding Canada’s proposed capital gains tax changes, many property owners are asking, "Do I have to pay capital gains if I sell my house?" or "Should I sell my investment property before the tax rules change?"

In June 2024, the federal government proposed increasing the capital gains inclusion rate—the portion of capital gains that is taxable. This change could significantly impact investors and property owners selling secondary residences, rental properties, or cottages.

But here’s the challenge: the rules haven’t been finalized yet. As Jamie Golombek explains in a recent Financial Post article, “Uncertainty remains as to what the final capital gains tax rules will look like, or even if they will be implemented at all.”

Despite this uncertainty, the Canada Revenue Agency (CRA) has announced it will proceed with collecting taxes based on the proposed higher inclusion rate until a final decision is made. This means that even if you sell now, you could still face a larger tax bill. If the rules are later changed or rejected, the CRA may adjust tax filings—but in the meantime, selling could cost you more than you expect.

The good news? Selling isn’t your only option. If you need access to cash or want to better manage your finances, refinancing or exploring alternative lending solutions could provide the flexibility you need—without triggering a large tax bill.

Ways to Access Cash Without Immediately Selling

If you need funds but aren’t sure whether selling is the best choice, here are some flexible ways to access cash while holding onto your property:

1. Refinancing Your Mortgage

- Access tax-free cash by using your home equity.

- Adjust your mortgage terms to fit your financial needs.

- Keep your property and continue building long-term wealth.

2. Alternative and Private Lenders

- Flexible lending options with easier qualification.

- Quick access to funds without selling your property.

- Short-term solutions to manage cash flow.

3. Reverse Mortgage (For Canadians 55+)

- Access tax-free equity with no monthly payments.

- Stay in your home while improving cash flow.

- Ideal for retirees on fixed incomes.

4. No-Payment Loan Options

- Interest-only or deferred payment loans.

- Manage expenses without immediate financial pressure.

- A flexible option to bridge financial gaps.

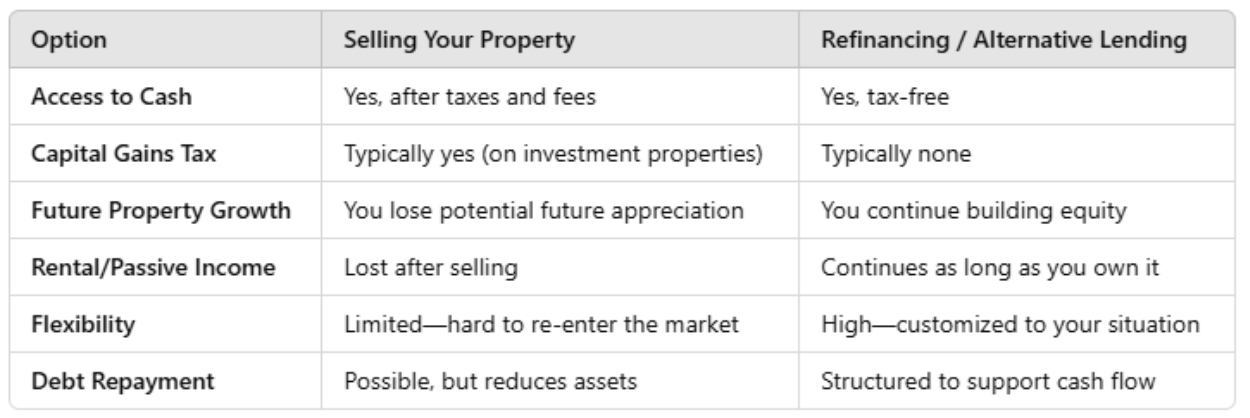

Comparing Your Options: Sell or Keep Your Property?

It’s important to weigh the pros and cons before making a decision.

Here’s a simple comparison of selling versus other financing strategies:

Let’s Build a Strategy That Fits Your Goals

Whether refinancing, working with private lenders, or considering a reverse mortgage, understanding every option is essential. I work closely with your accountant to create a strategy that helps you minimize taxes and achieve both your short- and long-term financial goals.

I offer a clear, side-by-side comparison of all your financing options so you can make the best decision for your financial future.

📞

Call me at 403-968-2784

📧

Email me at christine@flaremortgagegroup.com

Know someone else who’s unsure about what to do? Share this post—many Canadians don’t realize they have options beyond selling.

Let’s talk about what works best for

you.